“The National Bank of Blacksburg lost $2.4 million to Russian hackers and its insurer only wants to reimburse it $50,000, according to a lawsuit the bank filed in U.S. District Court in Roanoke,” stated The Roanoke Times on July 26, 2018.

How could they have protected their assets more effectively? What gaps do they still have with their cybersecurity? Unless they conduct a cybersecurity audit, gaps may still exist that could be exploited with fraudulent transactions and ransomware.

The Virginia bank is not alone. The 2018 AFP Payments Fraud & Control Survey shows that 78% of companies surveyed were targets of payments fraud last year, which demonstrates the crucial need for cybersecurity protocols and strict control governance. Additionally, the survey reveals that in 2017:

- 77% of organizations experienced Business Email Compromise (BEC)

- 54% of BEC scams targeted wires, followed by checks at 34%

- 77% of organizations implemented controls to prevent BEC scams

- 74% of organizations experienced check fraud, a slight decrease from 2016 (the biggest reasons businesses stick with paper checks)

- 28% were subject to ACH debit fraud and 13% were subject to ACH credit fraud

- 67% of payments fraud was discovered by the organization’s treasury staff

Is your bank’s cybersecurity up to snuff? Are you keeping ahead of threats and regulations like NYDFS? How do you know?

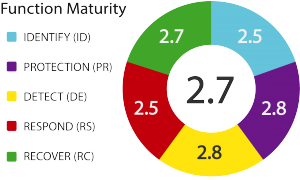

Find out with a Security Maturity Assessment

Whether you answer yes or no, you can find out if you’re really protected, where the gaps are and what to do about them with our complimentary Security Maturity Assessment.

Contact us and we will send you a sample report or schedule a Security Maturity Assessment for you. Our assessment is the culmination of everything we’ve learned about keeping banks safe since we started offering our Panoptic Cyberdefense managed services in 1998.